Accepting payments, especially credit cards, is very common these days. Restaurants, stores, gas stations, and even some vending machines accept credit cards as a form of payment. But most of the time you see these credit card swipe machines in mid-size to large businesses and not so often in smaller businesses like mom & pop stores, street vendors, or even a garage sale. That’s where the convenience of Verifone’s PAYware Mobile comes in.

The PAYware Mobile allows anyone with an iPhone to accept credit cards as a form of payment. The PAYware Mobile comes in 2 parts. The hardware, which is the actual credit card swipe system attachment for your iPhone, and the software, which is the iPhone app that you download from itunes.

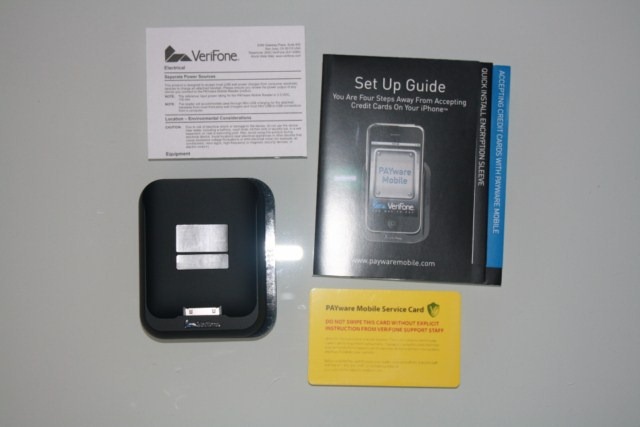

I was sent a demo unit which included the credit card swipe system, a demo credit card, a short manual, and the fine print. Packaged with the demo is a dvd which describes the usage of the PAYware mobile. The same set of videos can also be found on Verifone’s website.

Let’s talk about the hardware first. The quality of the actual unit feels strong and decent. There’s a dock connector where the iPhone slides into. On the top is a mini-USB connector port for charging or syncing the iPhone while docked. Next to the mini-USB port is a slot for the included stylus to slide in. The stylus is pretty short measuring at only 3 inches. It would be better if they included one of those extendable styli. This type of stylus does require some pressure to write with but I find that using your finger is a much easier experience.

The PAYware Mobile doesn’t add much width to the iPhone but it does double the thickness of it. So it’s not something that you’ll want to have on all the time. It has a nice grip feel to it and feels natural while holding it and sliding a credit card through it.

The PAYware app for the iPhone is free to download.

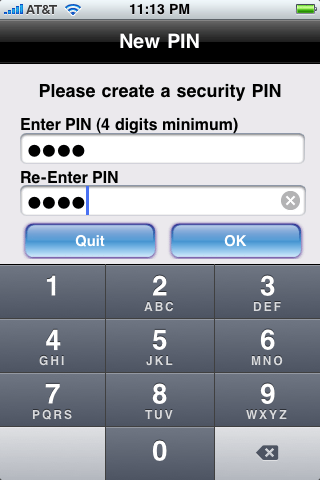

On first starting up the app you have to create a 4 pin security code.

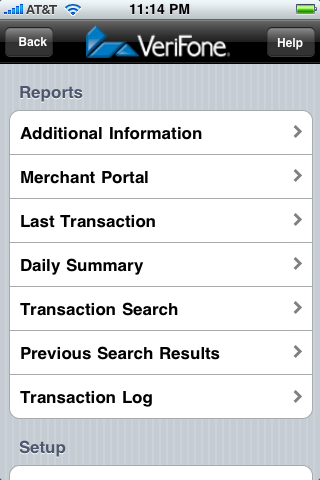

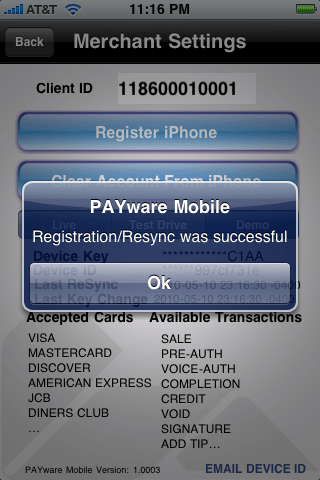

Clicking on Menu will get you to the Reports and Setup screen which lets you view various types of reports and setup your merchant account with the app. I did the setup with the demo account that Verifone gave me.

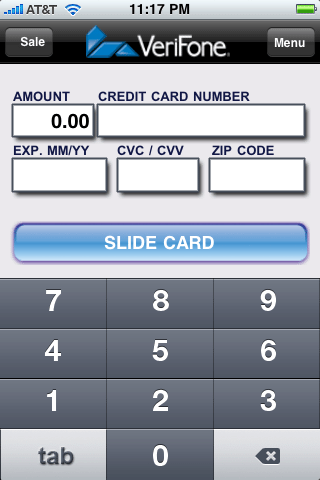

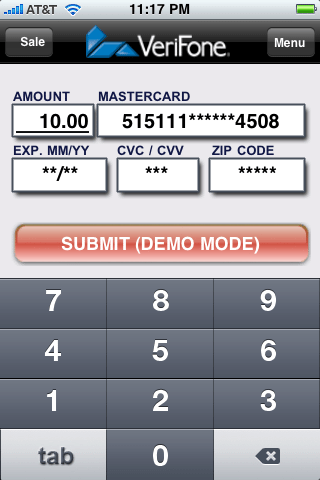

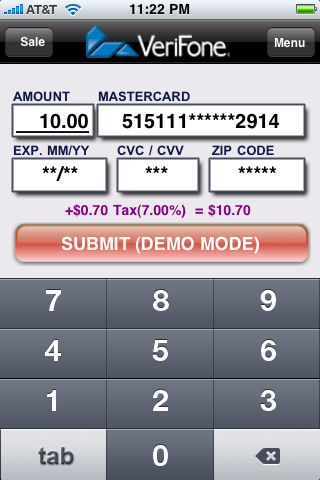

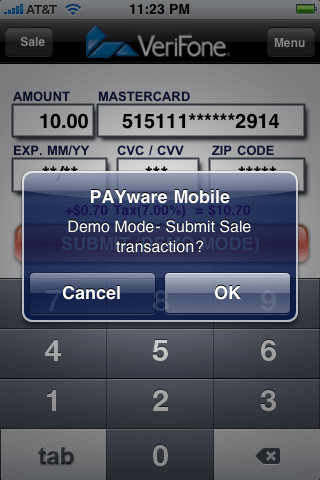

The main screen is where all the magic happens. You can either type in the credit card information or click on the “Slide Card” button which will initialize the card swipe for you to slide the card through. Once you swiped the credit card, all information will be filled out automatically except for the charge amount.

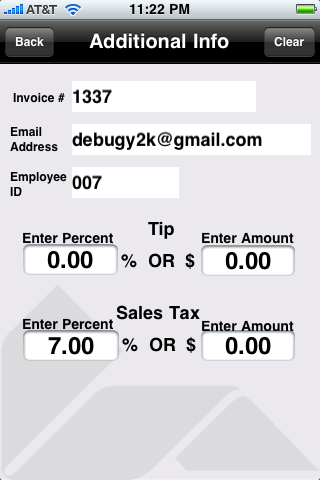

You are then given an option to enter additional information about the charge. This is also where you’ll enter the email address on where the receipt will be sent to.

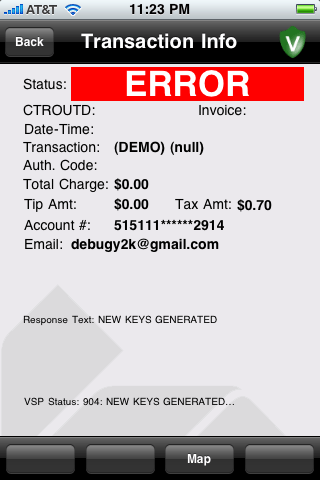

The charge obviously didn’t go through since this was a demo unit with a demo merchant account tied to it.

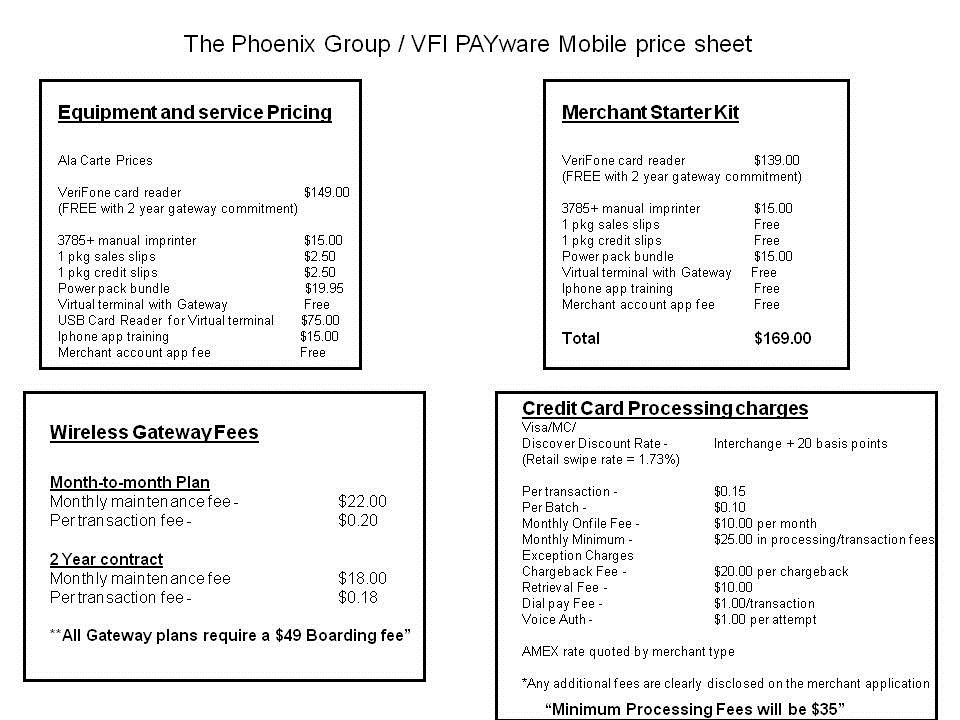

Now comes the obvious question. What are the rates for using this device? Let’s just say there are too many “fees” attached to this device. The hardware device costs start at $139 or free with a 2 year agreement. Then there’s the Verifone gateway fee. Plus there’s the actual merchant account fees. At the end it does get pretty pricey to use PAYware. The target users will be traveling salesman or tradeshow merchants. For smaller businesses such as mom & pop stores and garage sales, I might suggest that they try Square’s credit card swipe system which the hardware is totally free and the merchant fees are significantly lower. But Verifone’s PAYware does look more professional to use for businesses compared to Square’s cube shaped device.

Product Information

| Price: | $139, free with 2 year agreement Additional gateway fees and merchant fees |

| Manufacturer: | Verifone |

| Pros: |

|

| Cons: |

|

Gadgeteer Comment Policy - Please read before commenting

Although I don’t need such a device at the present time, I am very interested that they exist. Credit card transactions are becoming important for lawyers, especially small practitioners.

CLT

Does this work in the UK? I am aware such products and services are coming through so not surprised to see this, but I wonder if it’s available in the UK yet, could anybody advise?

@Guy M. – I think it will work anywhere since it works off the wifi or 3G network from the iphone. Buy you have to call Verifone to confirm if they support UK banks.

Word is that Verifone is coming to the UK, Canada and other countries with chip and pin.

To answer Guy’s question a chip and pin payment solution for smartphones will become available in the UK in autumn this year.

Most of the solutions available in the US aren’t available in the UK due to strict security standards requested by UK banks. In the UK (and increasingly in Europe, Australia, Asia, Canada and Russia) the more secure Chip and PIN technology is used superseding swipe payments as used in the US.

CreditCall http://www.creditcall.com is developing a smartphone app called CardEase Mobile http://www.cardeasemobile.com which allows fully secured credit and debit card transactions via your smartphone. It supports mag-stripe (for the US market) and Cardholder-not-Present (CNP) transactions ideal for all who need to accept payments on the go.

To find out how CardEase Mobile works have a look on YouTube http://www.youtube.com/watch?v=SpYWFDTgFLk.

In any case, which ever solution you choose, check with your bank first it complies with their Card Scheme to avoid being penalised by using any solutions which aren’t secure and approved in the UK.

I signed up for Square late September 2010 based on reviews and buzz. IT IS NOT WORTH IT. It’s early December and I’m switching over to another company who has a monthly fee but a customer support phone number and a 48 hour deposit time.

Square deposits the first $1000 but then holds the rest of your money for 30 days and deposits it in some illogical increment. So if you have a charge after that initial $1000 for example, on the 21st, you get some of it deposited 30 days later; if you had another charge on the 22nd, again, you get some of it 30 days later etc. You end up getting your money in small irregular increments which basically devalues your money.

Think of having $100 but getting it in pocket change as $1 on one day, $7 a few days later; $4 a week later and so on and so forth.

Plus if you do the math, their rates are high. You’re better off with a monthly fee and lower rates.

These types of iPlastic devices will continue to increase in popularity as they fill a giant sized void in the market. Coffee truck vendors, mon and pop pizza and Chinese food delivery, farmers market vendors are a small sample of small businesses that will benefit for the low entry cost required to take credit cards.